Custom Invoice Books Overview

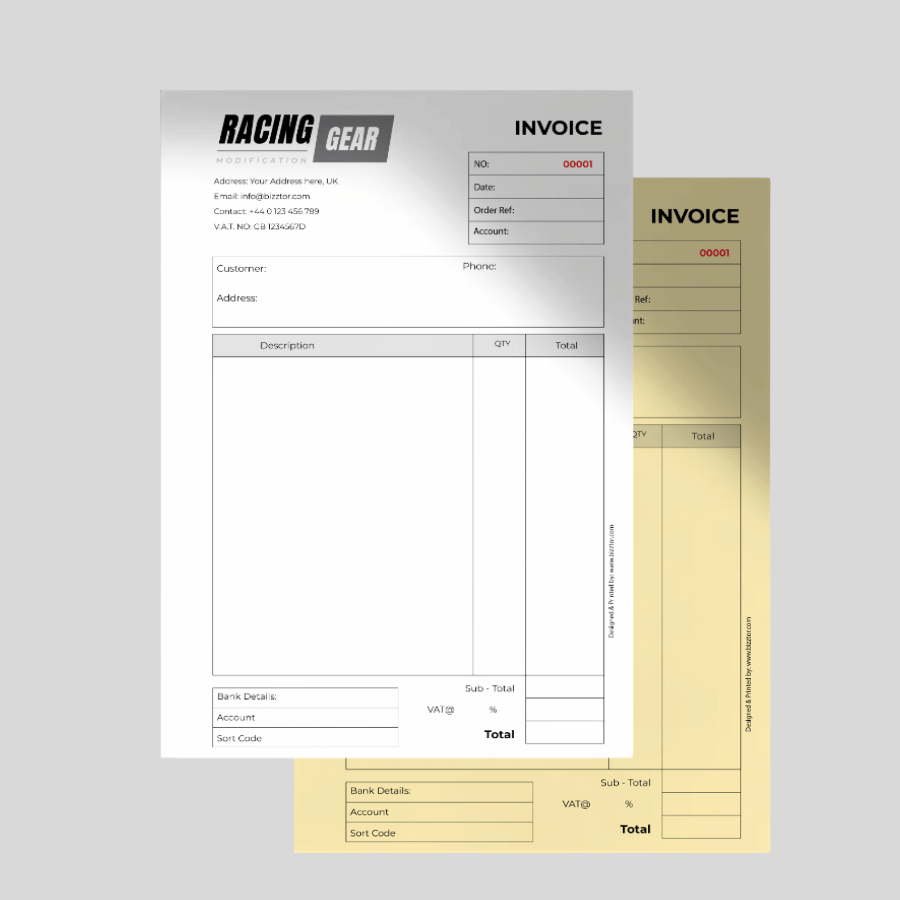

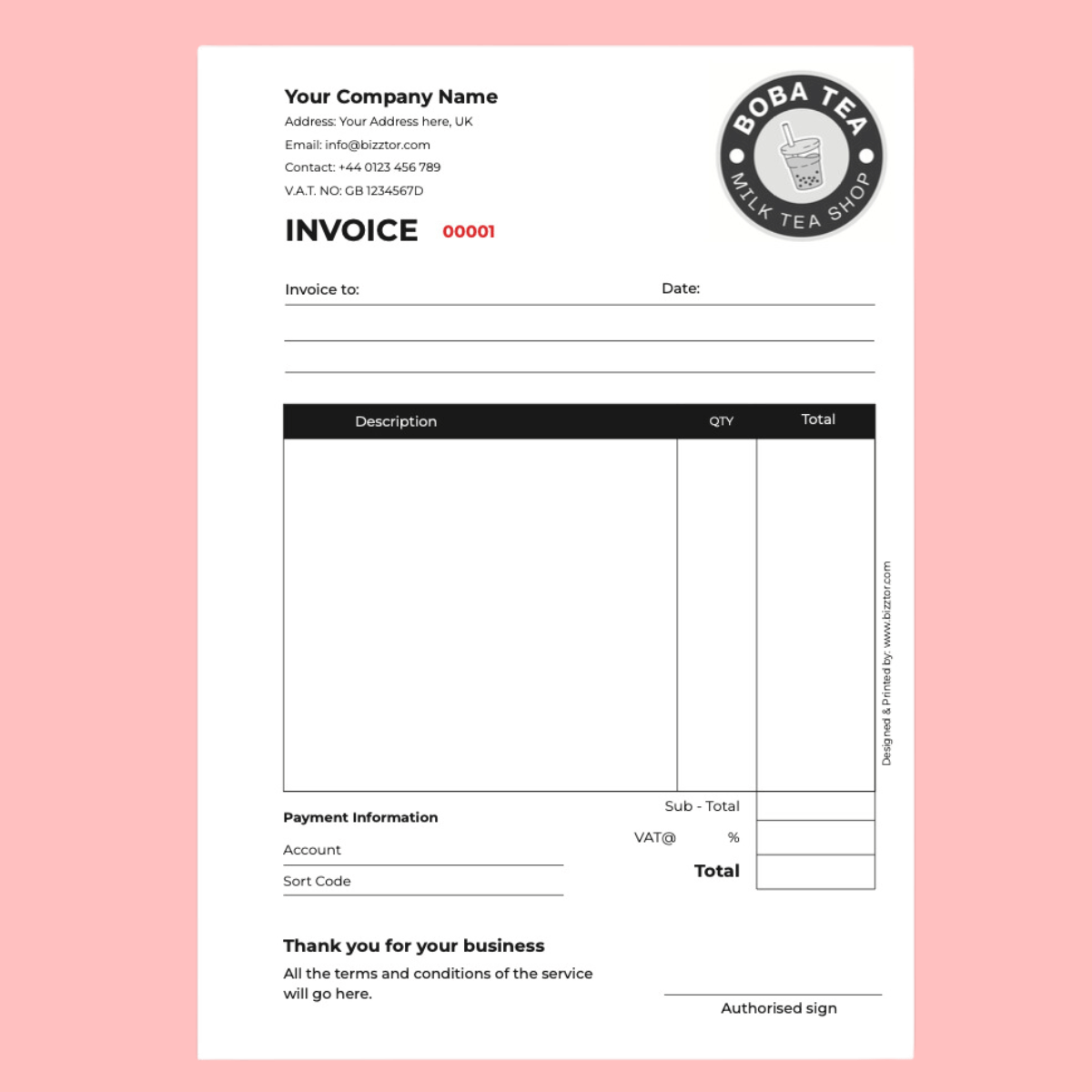

Elevate your business branding with our premium Personalised Invoice Books printed with black ink, finished to cater to both small and large businesses in the UK.

Available in a variety of sizes including A4, A5, A6, and DL, our personalised invoice books are made to fit for your business need, ensuring that your customisations needs are met. NearPrint‘s Duplicate invoice books are in 100 sets per book & 3 part books are in 50 sets per book. We offer free design and free delivery on all books.

Duplicate Invoice Books

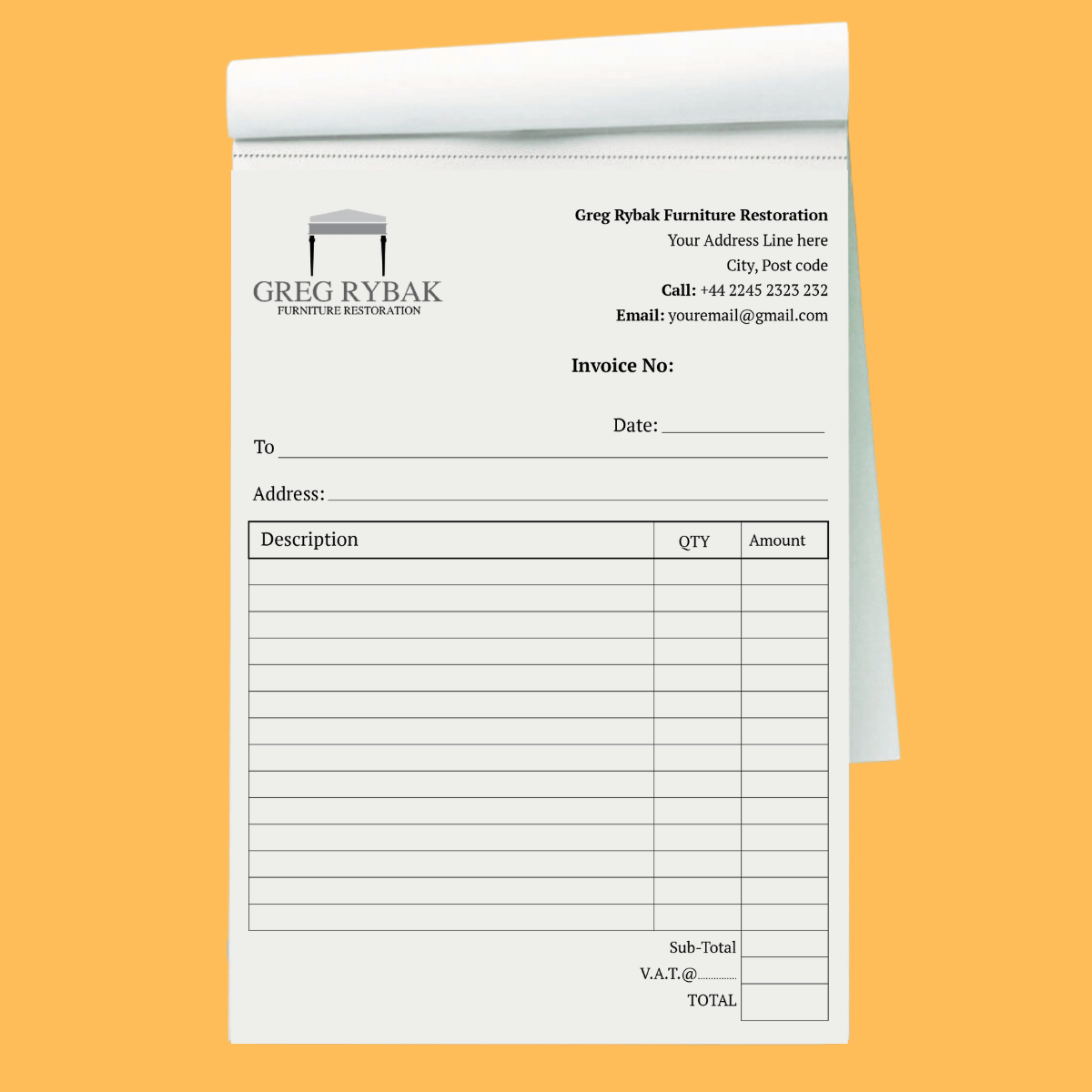

Duplicate Invoice book is a type of NCR (No Carbon Required) book that contains two copies of each invoice: the original and a duplicate. When an invoice is written on the first page, the details are automatically transferred onto the second page. This system makes it easier for businesses to track transactions and maintain accurate records without the need for complex accounting systems.

Our personalised duplicate invoice books are double value books offering 100 sets per book ( 100 original copies and 100 duplicate copies of invoice per book )

Triplicate Invoice Books

Triplicate invoice books contain three copies of each invoice: the original and two duplicates. When an invoice is filled out on the top sheet, the details are automatically copied onto the two subsequent sheets. This setup is particularly useful for businesses that require an additional copy of each transaction for record-keeping purposes, such as providing one to the customer, keeping one for the business’s records, and having an extra for accounting or legal purposes.

Triplicate invoice books streamline the process of creating multiple copies of an invoice, ensuring accuracy and efficiency in financial documentation.

Our triplicate invoice books contain 50 sets per book (50 copies of original and 50 of each duplicate)

Our Invoice book Features

- Custom Invoice books are printed using NCR Carbonless paper with your company logo and details.

- Each page features a perforation strip near the spine, making it easy to tear out the page.

- These comes with a manilla cover, cardboard backs, wrap around writing shield as standard and black spine tape. The strong binding ensures a robust product suitable for frequent transportation and use, both in and out of the office.

- Books are available in 2-part (duplicate invoice books), 3-part (triplicate invoice books), or 4-part (Quadruplicate) sets and in a choice of sizes: A6, A5, A4, and DL.

- Each sheet within the book is perforated as standard, allowing you to either detach pages or leave them in the book for your records.

- Our duplicate Invoice books have 100 Top copy & 100 Bottom copy per book. 3 part books have 50 Top copy, 50 Middle copy & 50 Bottom copy per book. Our duplicate invoice books comes with double value at affordable prices.

- Each book is sequentially numbered. You can specify where these numbers appear – commonly in front of ‘Invoice,’ ‘No,’ or any other preferred location. The price includes sequential numbering, so just let us know the starting number at the time of your order. Prefer your books without numbers? Simply select the ‘without numbering’ option.

- Free delivery: All our Invoice books orders are dispatched with Free delivery across the UK (England, Wales, Scotland, Highlands, Jersey and Northern Ireland)

- Custom and Extra Large NCR book options available. Get in touch with us for a quote.

- For coloured Books – please use this product

2 reviews for Personalised Invoice Books

There are no reviews yet.